Complimentary Story

Whom do you trust?Most of us have a small circle of family members or friends whom we trust. Some we trust more than others. Some we would trust with our lives. Others we trust only insofar as they earn our confidence. Our automobile mechanic, our doctor, our lawyer, our banker — all of these people need to earn our trust. Some pass, some fail.

Ironically, many of us place inordinate trust in folks we do not even know. If you have a “Last Will and Testament” as your estate plan, you are saying, in effect, “I trust the probate court to carry out my wishes exactly as I have set them forth in my will, to protect my estate from disgruntled relatives, and to quickly distribute my estate to my named heirs and beneficiaries. Since I will not be there to defend or explain my intentions, I trust the judge to ward off any and all challenges so that my will is held valid. I trust probate more than I trust my spouse, my children, my closest family members, my friends, and myself. Even though I do not know the judge who will be presiding over the distribution of my estate, I trust him or her with everything I have accumulated during my lifetime.”

Where there’s a will, there’s probate

Probate is the court process that, upon your death, takes control of the administration and distribution of your will and estate. The court makes every effort to follow the dictates of your will, but successful challenges to a will’s provisions are not at all uncommon. Probate court has the final say. But, the primary point is: wills go through probate court.

Added expense

Probating a will can easily eat up 3% to 10% of the gross value of your estate. That cost rises if the will is contested, if it is unusually complicated, or if the estate is particularly large or small. The judge in probate must follow a procedure that assures your debts are fully paid (including estate taxes, legal and administrative fees, and other costs) before the remaining assets are distributed to your heirs and beneficiaries.

No privacy

When a will enters probate, public announcements are printed in newspapers inviting creditors to submit their claims against your estate. Debts must be paid, of course, but the resulting publicity also opens your estate to anyone else who might have designs on your assets, including “forgotten” relatives. In addition, did you know that anyone (not just attorneys or people with a right) may go to the probate files of a county and read the probate wills and examine the list of assets?

A long wait

If your will is simple, your estate relatively small, and no challenges are made to the provisions it contains, your heirs and beneficiaries might receive their distribution after only eight to twelve months! More common is a one- to two-year probate process. Some wills have been debated and fought over for ten years or more! Sometimes partial distributions are allowed during the process — if your family can convince the court that they need some of the estate’s assets for monthly living expenses. But such requests can be denied.

The alternative — a living trust

A revocable living trust is an estate plan document which, similar to a will, is used to administer and distribute your estate on your death. However, with a living trust estate plan — unlike a will — you simply beneficiary your assets to your trust. Your assets would then go the trust on your death and be under the private control of your administrative trustee (most likely an adult child). Or, if you wanted to take your assets out of your own name and put them into the name of your trust, you can do that also. For example, instead of “John and Jane Doe, joint tenants,” your title would become “John and Jane Doe, trustees of the Doe Trust” If, as is usually done, you appoint yourself as the trustee of your living trust, you retain all control and management of your assets. It all happens on paper, and the day-to-day ways you’ve managed your property, business, and finances do not change. You can trust your living trust because, as trustee, you are simply continuing to trust yourself.

Married persons normally name themselves as co-trustees of their revocable living trust and will often name grown children as “successor” or “back-up” trustees (although anyone you choose can be appointed to that position). The important point to remember is that you, or you and your spouse, or your personally chosen back-ups are the only persons who will have control of your estate when it’s put into a revocable living trust.

Where there’s a living trust, there’s no probate!

You can conceptually think of a living trust as a “non-probate will.” A regular last will and testament must go to probate court to be administered. However, a living trust does not go to court, but is administered privately by your successor trustee or co-trustees. No courts, no court costs, no probate, no probate fees. Upon your death, your successor trustee simply inventories your assets, pays your debts, files your last year’s tax return(s), if any, and distributes your estate to your designated heirs.

There’s minimal expense

The initial costs for setting up a living trust are a little higher than drafting a will, but eventually the cost of putting an estate through probate must be added to the cost of a will. Usually, the fee for setting up a revocable living trust also includes drafting documents for durable power of attorney, health care power of attorney, living wills and real estate deeds.

Writing a will may cost a little less than a trust, but remember that the average cost for probating a will is 3% to 7%. For a probate estate valued at $300,000, that’s $12,000 to $21,000 going to pay for probate!

There’s privacy

With no will to probate and no public notices, the disposition of your estate remains completely private. In a sense, as far as creditors are concerned, it doesn’t matter whether you are alive or dead because your trust owns everything, and the trust continues to be responsive to all of your financial affairs. As trustee, while you are alive and competent you are in control of the trust. When you die or become incapacitated, your backup trustees take over responsibility for the trust. Usually, upon your death your trust terminates, and the estate is disbursed according to your wishes. However, you may choose to have your trust continue for a number of years to provide management and protection for minor children, a child with special needs, or an heir who is legally an adult but immature or irresponsible. And for as long as your trust endures, only those whom you choose to share it with will know anything about its contents.

There’s immediate transfer

If you are married and your spouse is co-trustee with you of your living trust, your spouse automatically and instantly takes over sole management of the trust. If you are the sole trustee, control of your trust immediately passes to your back-up trustees. There are no papers to file, no court procedures, no temporarily frozen assets.

Conclusion

A revocable living trust estate plan can be of tremendous benefit when used under the proper circumstances. However, it is important to understand that with a living trust you are not going to have the supervision of the probate court and, therefore, you are placing great trust in your named successor trustee/administrator. Careful thought and consideration should be given to this choice. Usually, mature, adult children are chosen.

However, where children are yet minors or for any other reason not able to fulfill this responsibility, some other trusted individual, attorney, or bank trust department will need to be considered. It is also important to understand that each individual or family situation is unique and that this article is not intended to provide, nor should it be interpreted as providing, specific legal counsel. Seek personal legal advice prior to the preparation of any legal documents or plan.

For a free consultation, call Atty. Joe Helm 262-251-4210 / Email JoeHelm@mclario.com

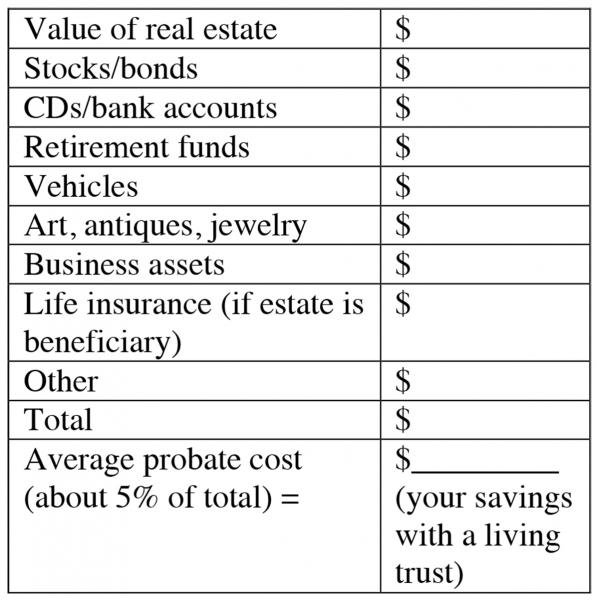

Calculating the cost of probate: (See photo)